Buy and Borrow

What Exactly is an Adjustable Rate Mortgage?

June 01, 2017

A mortgage is a big deal. Since it’s often one of the largest loans that people take out, it’s important to understand the details. But all the mortgage-related terminology can be confusing, especially when you’re new to the process.

So if you’re looking for mortgage options and don’t quite know what an adjustable rate mortgage is, don’t worry! Let’s break down the details of an adjustable rate mortgage so you can easily decide if it’s the right choice for you.

Adjustable Rate Mortgage Definition

An adjustable rate mortgage (ARM) is pretty much just what it sounds like. It’s a mortgage where the interest rate may change over time.

Typically an adjustable rate mortgage will offer a lower interest rate for a set number of years. After that initial period ends, the interest rate may increase or decrease.

Consider the Caps for Adjustable Rate Mortgages

A major consideration when looking at adjustable rate mortgage options is the maximum amount the interest rate can adjust to.

There is often an initial cap that indicates the highest an interest rate could potentially reach for each adjustment. There may also be a lifetime cap that indicates the very highest an interest rate can go during the life of the mortgage.

Pay attention to these caps to find the best offer for you. Some caps are very friendly to the borrower and others might be steeper than you want to go. This can help you decide if an adjustable rate mortgage can work for you.

What do the Numbers Mean for Adjustable Rate Mortgages

There are many different types of adjustable rate mortgage options. Pay attention to the numbers to better understand the specifics of the loan.

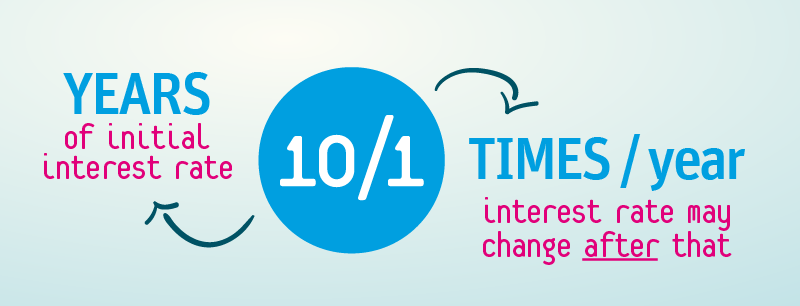

The first number refers to how many years you’ll get the lower initial interest rate for. The second number often refers to how often the interest rate may change after that initial period.

For example, in a 10/1 ARM, the “10” means that you’ll get to keep the initial interest rate for 10 years and the “1” means that the interest rate may change once a year after the initial 10 years have passed.

Breaking down the meaning of "10/1 ARM."

If it is a 3/3 ARM, the first “3” means that you’ll get to keep the initial interest rate for three years and the second “3” means that the interest rate can only change every three years.

Keep in mind that you may see offers with a larger second number, like a 3/27 ARM. These are often aimed at buyers who present more of a credit risk. In those cases, the second number represents the number of years that the interest rate may change.

So if it is a 30 year mortgage, the 3/27 ARM would have the initial interest rate for three years and then the remaining 27 years on the mortgage would have the adjustable interest rate. This is often a riskier loan option, since there are many chances for your monthly payment to potentially increase.

Adjustable Rate Mortgage vs. Fixed Rate Mortgage

Since adjustable rate mortgages have interest rates that may vary after a set period of time, it’s possible that payments could eventually go up.

An alternative option is a fixed rate mortgage. Whatever the interest rate is when you sign a fixed rate mortgage, it will not change over time.

Both options have advantages and disadvantages, so it all depends on your needs.

Who May Benefit from an Adjustable Rate Mortgage

Since adjustable rate mortgages have changing interest rates over time, some people may think they’ll definitely end up paying more over time. However, it all depends on your circumstances.

You may benefit from an adjustable rate mortgage if you:

- Want lower payments during the initial years of your loan

- Expect to move into a different home within the next 10 years

- Plan to pay off your mortgage within the next 10 years

- Would like to maximize your buying power

- Expect your income to significantly increase in the coming years

To decide if an adjustable rate mortgage is right for you, also make sure to keep in mind the specifics of the offer. Lenders often have promotions that could impact your decision by offering additional savings.

For example, if you know you’re planning to stay in your home for less than ten years and a lender has an adjustable rate mortgage offer that covers closing costs or offers other savings, the adjustable rate mortgage could cost you less money than a fixed rate mortgage.

Pay attention to those details so you don’t miss out on potential savings!

Category

Buy and Borrow

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida