Plan and Retire

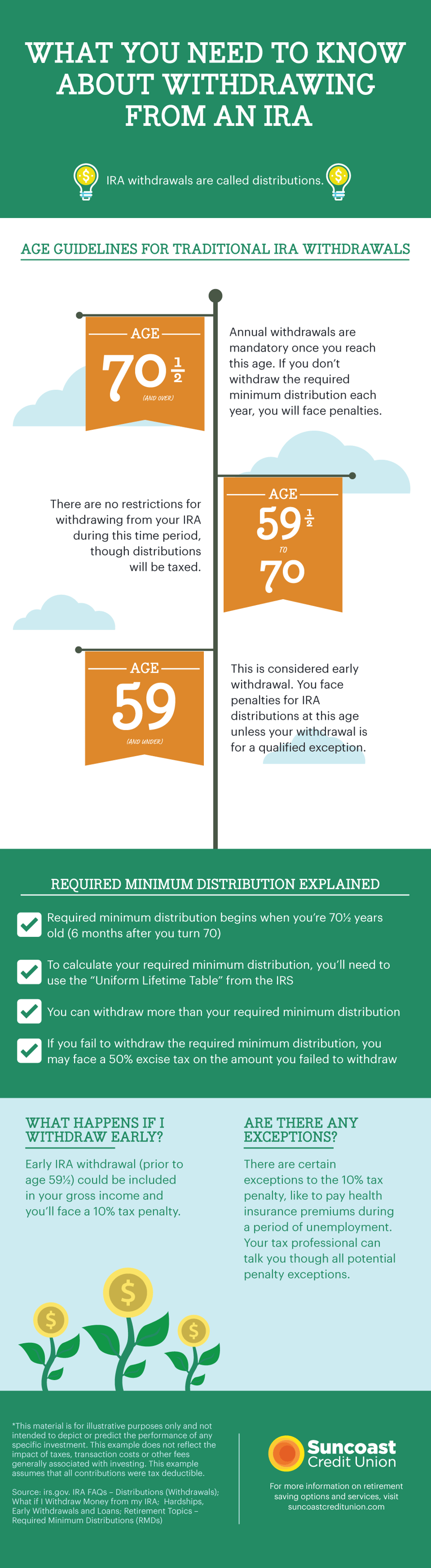

What You Need to Know About Withdrawing from an IRA (Infographic)

August 06, 2018

An IRA (individual retirement account) can help you save for retirement. But there are specific rules about when you can withdraw from an IRA that you should learn to make sure that you get the most from your money when the time comes.

Keep this infographic handy as you approach retirement. It can help you remember when it’s the appropriate time to withdraw, what penalties you could face if you withdraw early and other crucial points of reference.

For more information on retirement saving options and services, check out our retirement planning resources.

Sources:

https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras-distributions-withdrawals

https://www.irs.gov/newsroom/what-if-i-withdraw-money-from-my-ira

https://www.irs.gov/retirement-plans/hardships-early-withdrawals-and-loans

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

*This material is for illustrative purposes only and not intended to depict or predict the performance of any specific investment. This example does not reflect the impact of taxes, transaction costs or other fees generally associated with investing. This example assumes that all contributions were tax deductible.

Category

Plan and Retire

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida