Plan and Retire

Why Educators Love 403(b) Retirement Plans

May 22, 2017

Employees in the education field know that though it is a rewarding career path, it can be exhausting. Teachers, administrators and other public school employees spend years devoted to helping students, so they surely deserve to be able to kick back and enjoy retirement when the time comes.

That’s why it’s so important for school employees to plan for the future. In order to relax and retire with ease, there has to be a plan in place for the funds you’ll need to pay bills and enjoy life after retirement. One of the most popular retirement planning options for people who work in the education field is a 403(b) plan. Let’s go over what this plan is and why educators and school employees love it so much.

What is a 403(b) Plan?

A 403(b) plan is a type of retirement plan that offers tax sheltered accounts to specific groups of eligible people. Employees who work at public schools, nonprofit organizations and other tax-exempt organizations are often eligible for 403(b) plans.

What is the difference between a 401(k) and a 403(b)?

Both 401(k) and 403(b) plans are designed to help employees save for retirement. However, 403(b) plans are only available to specific people who work for tax-exempt organizations. The administrative costs for 403(b) plans tend to be lower in many cases.

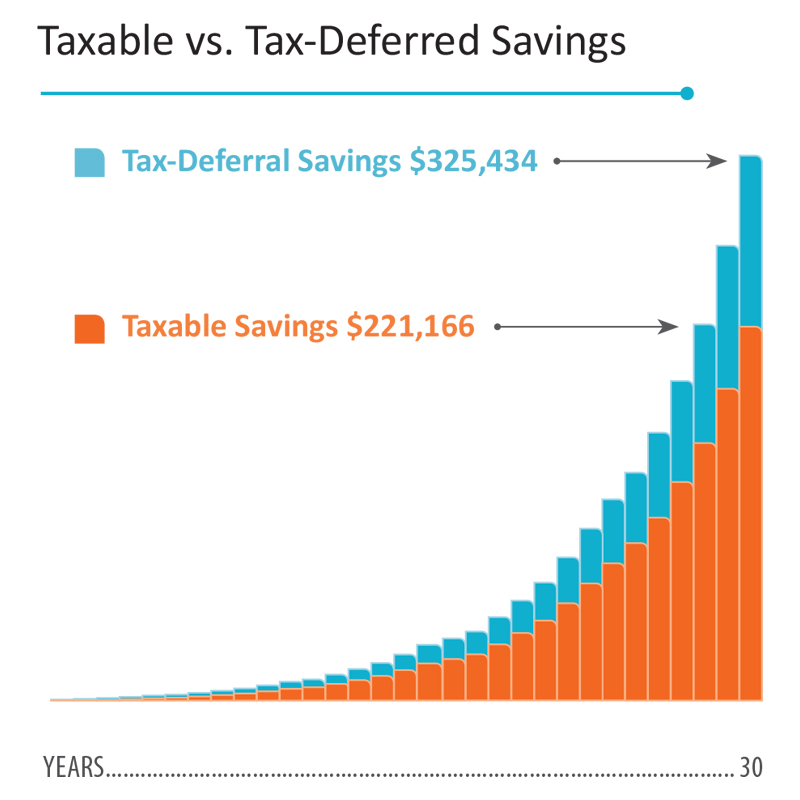

A $100 per paycheck contribution over 30 years in a tax-deferred 403(b) account will outpace a taxable savings account by over 30%! As you can see, the tax-deferred 403(b) account value is $325,434 compared to $221,166 in the taxable account. This example assumes a before-tax 8% annual rate of return and 25% marginal tax bracket.

Benefits of 403(b) Plans

There are many reasons why employees of public schools love 403(b) plans for their retirement. It all comes down to the excellent benefits that 403(b) plans have to offer.

Some of the benefits of 403(b) plans include:

- Tax-deferred savings growth and compounding

- Lower your taxable income

- Contributions can be made automatically through your paycheck

- Some early withdrawal options may be penalty-free

- Some employers offer 403(b) contribution matches

- Roth 403(b) options may be available

Depending on the specific 403(b) plan, there are additional benefits that may be a part of the plan. You may have the option of buying additional years of tax-free service credits or making catch-up contributions after you reach a certain age or work a certain number of years. Talk through the details of your plan to make sure that you are getting the best out of your 403(b) benefits.

Tips for Making the Most of Your 403(b) Plan

Like any retirement plan, it is best to begin early to make the most of your 403(b) account. Even if you don’t contribute a lot in the beginning of your career, even small contributions now can have a major impact later. Also, always take advantage of any employer match programs that are available to you. If your employer is willing to match contributions, it is free money! Don’t miss out on that.

If you work for a public school and don’t have a 403(b) account, look into it today! Your future is worth the investment.

Suncoast Investment Services is a marketing name used by Suncoast Credit Union. Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Suncoast Credit Union and Suncoast Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Suncoast Investment Services, and may also be employees of Suncoast Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Suncoast Credit Union or Suncoast Investment Services. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value |

FR-1808738.1-0517-0619

Category

Plan and Retire

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida