Plan and Retire

Why You’re Never Too Young to Save for Retirement

May 10, 2017

Stop a moment and think of the life you want to have someday, after you retire. Close your eyes and really picture what you want.

Maybe you’re thinking of sandy beaches with waves crashing on the shore and a tropical drink in your hand. Or you could be picturing a trip around the world, seeing all of the sights you’ve always dreamed of. Perhaps you’re envisioning yourself curled up at home with a bunch of good books and family popping in and out of your house.

No matter what your perfect retirement looks like, there is one thing that is for sure. You’ll need money for retirement.

It’s easy to think that you have plenty of time. Maybe you’re decades away from retirement age and it doesn’t seem like much of a priority just yet.

Whatever age you are as you read this, it is time to start planning for retirement. It’s that simple! Your future self is counting on you to make those retirement dreams come true.

Start Early, Save More

Here is the not-so-secret key to saving for retirement: the earlier you start the more money you will save. Sounds obvious, right?

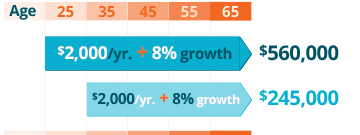

What you may not realize is how big of a difference it makes to start saving for retirement at a younger age. Consider the example below that shows how much difference ten years can make for your long-term savings.

Consider this scenario: If you begin saving for retirement at 25, putting away $2,000 a year for just 40 years, you'll have around $560,000, assuming earnings grow at 8 percent annually. Now, let's say you wait until you're 35 to start saving. You put away the same $2,000 a year, but for three decades instead, and earnings grow at 8 percent a year. When you're 65 you'll wind up with around $245,000 -- less than half the money.

For illustrative purposes only. Source: Bankrate.

In that example, you would end up with less than half of the savings amount if you start at 35 years old than you would if you started at 25 years old. Though some of those variables may change, the point is no matter how young you are, beginning a retirement savings plan now will help immensely later.

Life Gets More Expensive as You Get Older

As you move up in your career over the years, your salary will likely increase. So it is easy to think that maybe waiting for retirement will be easier later when you have more money.

Unfortunately, that’s not always the case. Even if you make more money over time, you will also probably have additional expenses that you didn’t have when you were younger.

Even if you have bills now, getting older tends to increase your responsibilities. You may need to pay off your student loans. You may get a mortgage or start a family. No matter what your next few years will look like, you will always have some sort of bills to pay.

That’s why you should still make retirement planning a priority in your younger years. You don’t have to put aside a ton of money you don’t have, but regularly contributing to a 401(k), 403(b) or Roth IRA is a good start, even if the contributions are small.

You Never Know What Will Happen in the Future

No one knows what the future holds. An unexpected health issue when you get older can really cut into your savings. Or maybe something wonderful will happen, like the opportunity to go on a life-changing trip.

You can’t know the future, but you can plan to be prepared to financially handle the unknown. Start saving for retirement as soon as you can and help make your future bright!

Category

Plan and Retire

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida