Safety and Protection

What You Need to Know About Card Cracking Scams (Video)

August 09, 2017

A mysterious friend request or new follower on social media may seem harmless. But one wrong move is all it takes to lose money to a scammer and even become an accomplice to a crime.

Card cracking (sometimes known as card popping) is a scam that lures people in using social media and then tricks them into committing fraud.

Let’s break down the details of this scam so you can protect yourself.

How Card Cracking Works

Like most scams, it’s important to remember that scammers use multiple methods to trick their victims. So it is important to stay informed and always err on the side of caution when it comes to your personal information and social media accounts.

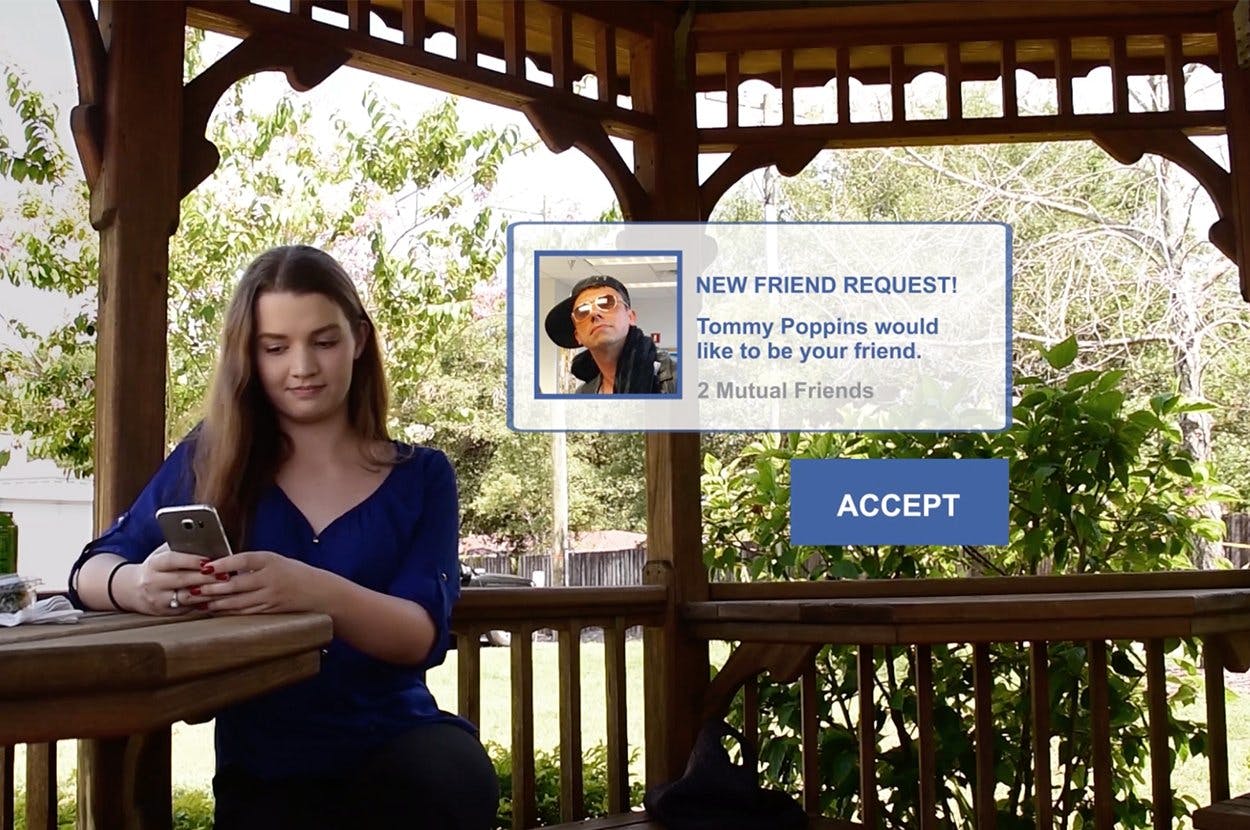

Scammers create profiles like this one to trick people into sharing their personal information.

Scammers create profiles like this one to trick people into sharing their personal information.

One of the most common forms of card cracking goes like this:

- Fraudster creates social media account that showcases a lavish lifestyle to trick potential victims

- Fraudster sends you a message on social media with an offer for you to make quick, easy money

- Fraudster asks you to give your debit card and PIN or your online bank account information

- Fraudster deposits fraudulent checks in your account, then withdraws money with the promise to give you a portion of the profits

The idea behind this scam is that by the time your financial institution determines the check was fraudulent, the money is already gone. Fraudsters will tell you beforehand that your financial institution will reimburse you if you report your card as stolen. This is NOT TRUE!

Card Cracking Can Cause Serious Consequences for You

This is the part that scammers don’t want you to know: if you fall for card cracking, you are held liable.

If you willingly give someone access to your bank account, your financial institution will not be able to recover your money. The fraudster may even clean out your account. But since you gave them access, it could be hard to prove that the transactions weren’t authorized.

Think of it this way, the moment you hand over your account information, you are authorizing that person to access your money. This could leave you with nothing.

Even worse, by knowingly sharing your account information with a scammer, you can become an accomplice to the crime. Bank fraud is a serious offense that could leave you with steep fines or a possible prison sentence.

Variations of the Card Cracking Scam

Remember, fraudsters are always coming up with new ways to trick you. This scam has many different versions, all designed to trick you into sharing your personal information or handing over your debit card.

Variations of the card cracking scam include an in-person approach where fraudsters might approach college students on campus. They pretend to be a college student with a frozen account. They’ll give you a sob story and ask if you would cash a check for them.

Sometimes the scammer may present the card cracking operation as a legitimate business opportunity. They may pose as employees of your financial institution. Other times they pretend to offer scholarships or student loan forgiveness in an attempt to get you to share your personal banking information.

No matter what form it comes in, the common element in card cracking is that fraudsters will ask for your bank information, debit card or PIN.

How to Protect Yourself from Card Cracking

Since fraudsters are always adjusting their scams, the most important thing you can do to protect yourself is keep your personal data safe.

- NEVER give your account numbers, passwords, PINs or debit cards to strangers

- If someone is offering free money, it’s probably a scam

- Report suspicious bank account activity as soon as you see it

- Legitimate scholarships, job offers or contests will not ask for your debit cards, PINs or online banking information

Spread the Word!

New people are falling for these scams each day. Help spread the word by sharing this article on social media.

Suncoast members, if you have been a target or are concerned you may have been a victim of one of these scams, please send an email to abuse@suncoastcreditunion.com.

Category

Safety and Protection

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida