Simply Suncoast

Why Florida Teachers Should Choose Suncoast Credit Union

April 05, 2021

Back in 1934, a group of local educators founded Hillsborough County Teachers Credit Union. Though we’ve grown over time and changed our name to Suncoast Credit Union, our commitment to serving teachers will always remain.

Today, we’re the largest credit union in the state of Florida. Anyone who lives, works or worships in one of the counties we serve can become a member. There are a ton reasons why so many people choose Suncoast to be their financial partner, but let’s focus on why we’re an excellent credit union for Florida teachers and the entire education community.

Suncoast Understands Teachers’ Needs

Since we were founded by teachers, we understand the unique needs of people who work in the education industry. We have products and services to help you throughout each stage of your life. Need everyday banking options? We’ve got you covered with fee-free checking accounts. Need to buy a car? We make it easy to get preapproved at a low rate.

If you’re looking to buy a home, we have a ton of options to help you find, finance, and protect your home. Teachers and other school employees even qualify for our Community Heroes Mortgage program, because we know that educators are truly heroes and deserve the very best!

We’re also designed to help you save money across the board and offer a ton of free services. Teachers do so much to support the community, so it’s out honor to help support them with the very best financial services.

Suncoast Helps Teachers Prepare for Retirement

Another reason why Florida educators should bank with Suncoast is because we have everything you need to prepare for retirement. Our Suncoast Trust & Investment Services team is ready to help you plan for retirement, with expert advice based on your needs.

Our team can help you open a 403(b) or 457(b) account if you’re just getting started. They can help you make a personalized retirement plan to reflect your goals. And if you’re nearing retirement and want to consider the deferred retirement option program (DROP), you can get a complimentary DROP consultation to see if it’s right for you.

Suncoast is Committed to Education

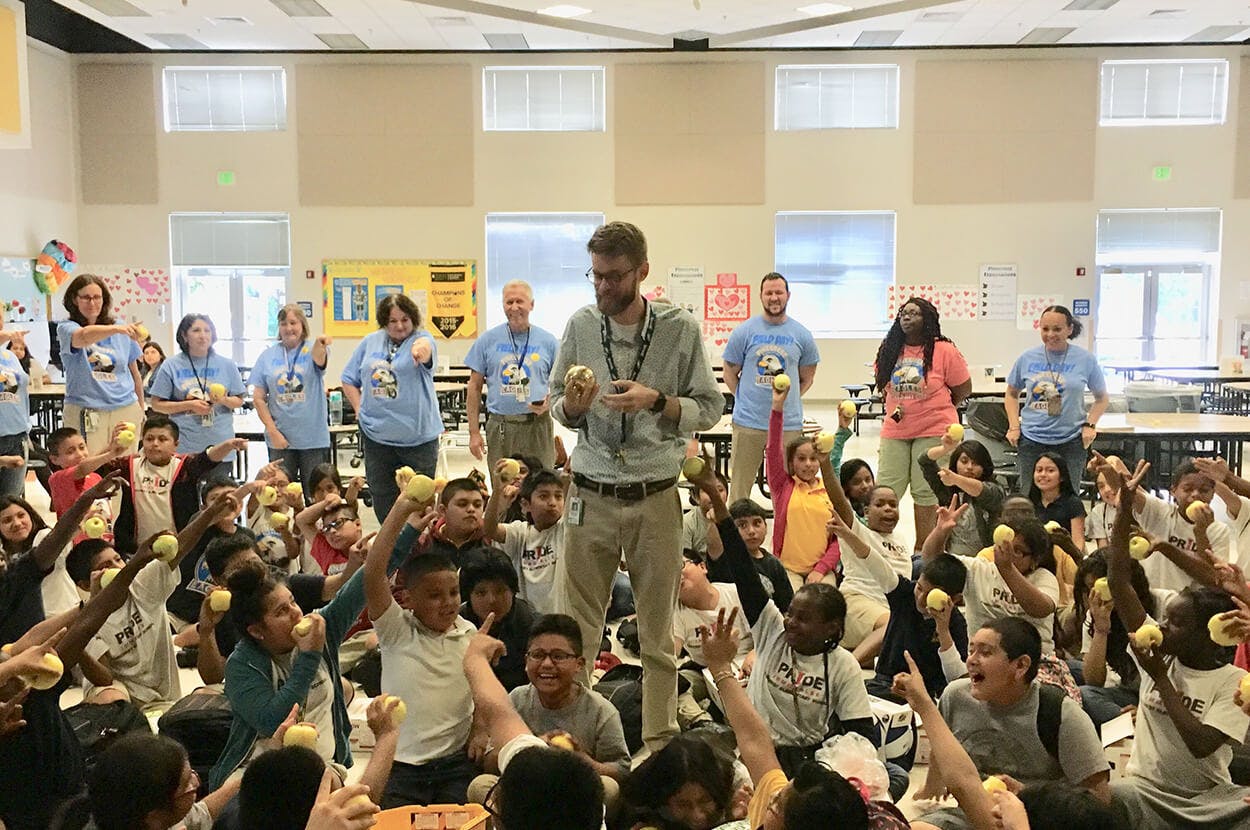

Aside from offering the products and services teachers need, Suncoast is also an avid supporter of education. And our members get the chance to help local children too, because every time they use a Suncoast credit or debit card, we donate two cents to the Suncoast Credit Union Foundation.

Our foundation has helped fund many education-related initiatives, from STEAM programs to classroom supplies for teachers. We also offer college scholarships and in-school financial literacy programs for students of all ages.

Ready to become a Suncoast Member? We look forward to serving you!

Suncoast Investment Services is a marketing name used by Suncoast Credit Union. Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Suncoast Credit Union and Suncoast Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Suncoast Investment Services, and may also be employees of Suncoast Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Suncoast Credit Union or Suncoast Investment Services. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value |

Category

Simply Suncoast

Tags

Find a Branch or ATM

We’re local, serving multiple counties in Florida