Empowering Change, Every Day with Suncoast Partners

At Suncoast, we know every person can make a positive difference. Our team uses outreach programs and partnerships to give back to our local communities with youth outreach, financial literacy workshops, services for seniors, and programs that encourage childhood reading. We love our Suncoast partners, and we're proud of the work we do for our community.

How We're Helping

We love the communities we serve, and it shows! Through both philanthropic and educational efforts, we pride ourselves on the ability to impact local families, schools and organizations.

Youth Outreach & Financial Literacy Workshops

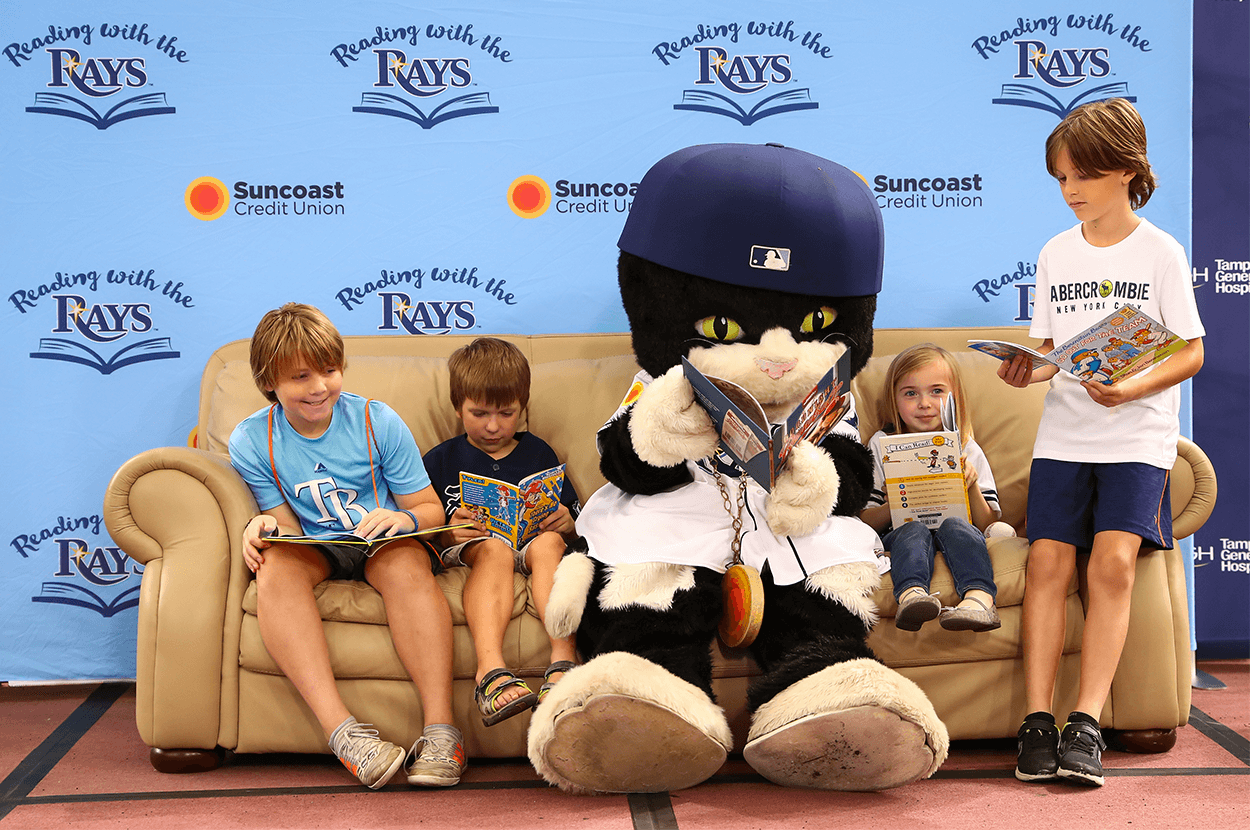

Tampa Bay Rays Partnership

Programs for Seniors

Tampa Area Credit Union for Kids Foundation - Helping Community Leaders

Since 1994, the Tampa Bay Area Credit Unions for Kids and Suncoast Credit Union have joined forces with other local credit unions to make a lasting impact on kids in our communities.

Over the last 15 years, the Tampa Bay Area Credit Unions for Kids has donated over $4 million to organizations that support our community’s children. These donations have impacted the Johns Hopkins All Children’s Hospital, The Center for Autism, a Fellowship at Johns Hopkins All Children Institute for Brain Protection Science, Tampa General Hospital’s Pediatric Palliative Care Suite, and Pediatric Long-Term Monitoring Suite.

Our most recent initiative is Project Lead, a collaboration with the Hillsborough County Sheriff’s Office and the Boys and Girls Clubs of Tampa Bay. Project Lead is a unique and innovative program that drives meaningful impact in communities that need us the most. Local youth receive mentorship and support from mentors who wear a badge. These relationships increase the respect between law enforcement and the community, help reduce crime, and help decrease out-of-school suspensions.