Fee-free Checking Accounts

At Suncoast, we know that free is better than fees! That’s why our checking accounts have all of the features you need without any of the added costs. Our fee-free checking lets you bank without breaking the bank!

Discover the Right Checking For You

Select an option below to open a checking account with:

Explore Suncoast Checking Account Benefits

Checking Account Rates

† Annual Percentage Yield (APY) effective 03/18/2024. Rates may change at any time without prior notice, before or after the account is opened. Fees could reduce earnings on the account. Terms and conditions may change without notice.

Good For You. Good For The Community.

Whether you’re banking on the go or giving back Suncoast makes it simple for you.

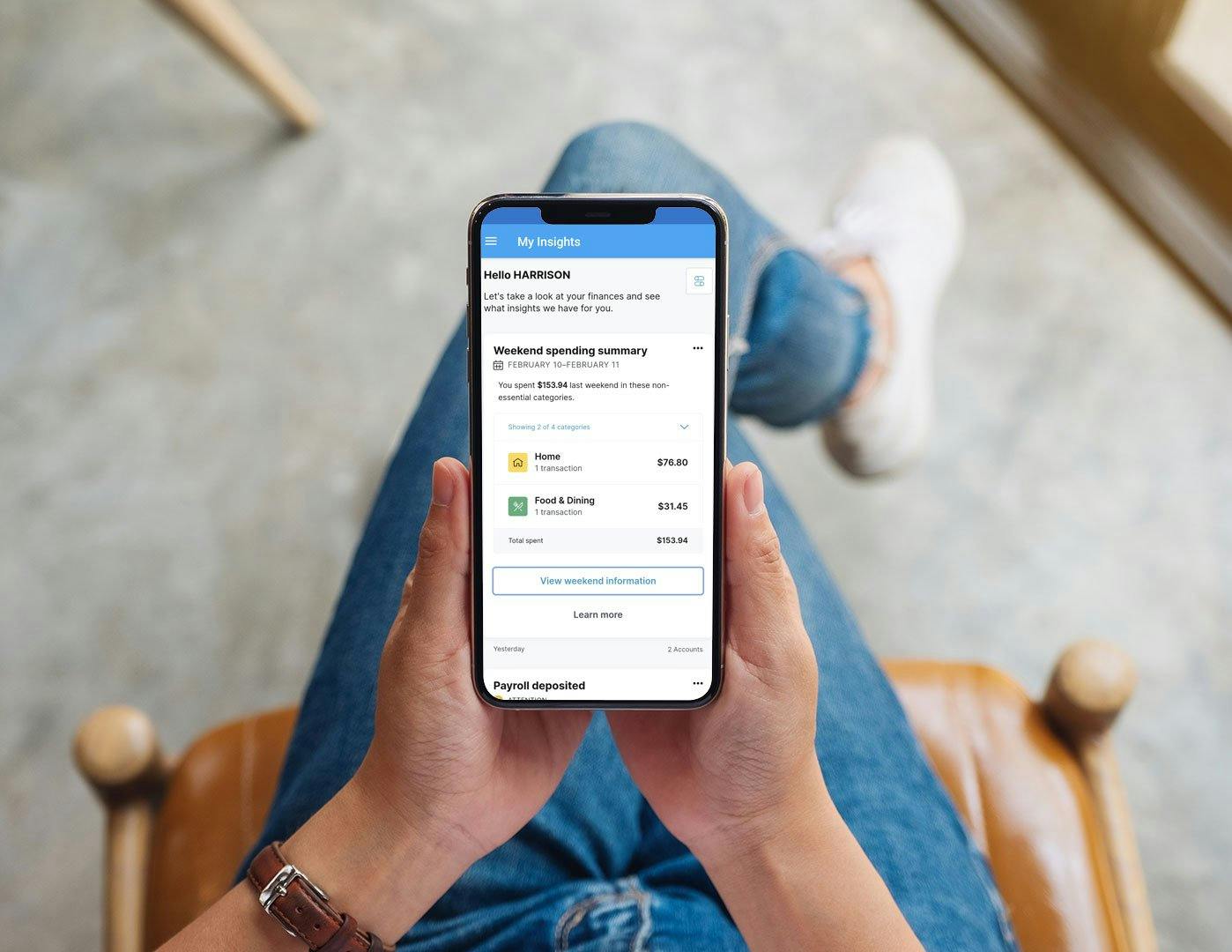

Download the SunMobile App

Our SunMobile app lets you manage your finances quickly, safely and securely from the convenience of your smartphone or tablet.

Giving Back is in our DNA!

A swipe, tap or click from your Suncoast debit or credit card supports our local communities through the Suncoast Credit Union Foundation.