Download the Suncoast App

Suncoast Credit Union puts the power of your finances in your pocket with the SunMobile app. This free and secure app lets you manage your accounts easily from your smartphone or tablet. Need to deposit a check? No problem! SunMobile allows for quick and easy mobile deposits. Paying bills or sending money to friends and family is a breeze – all within the app. SunMobile provides a convenient way to manage them on the go.

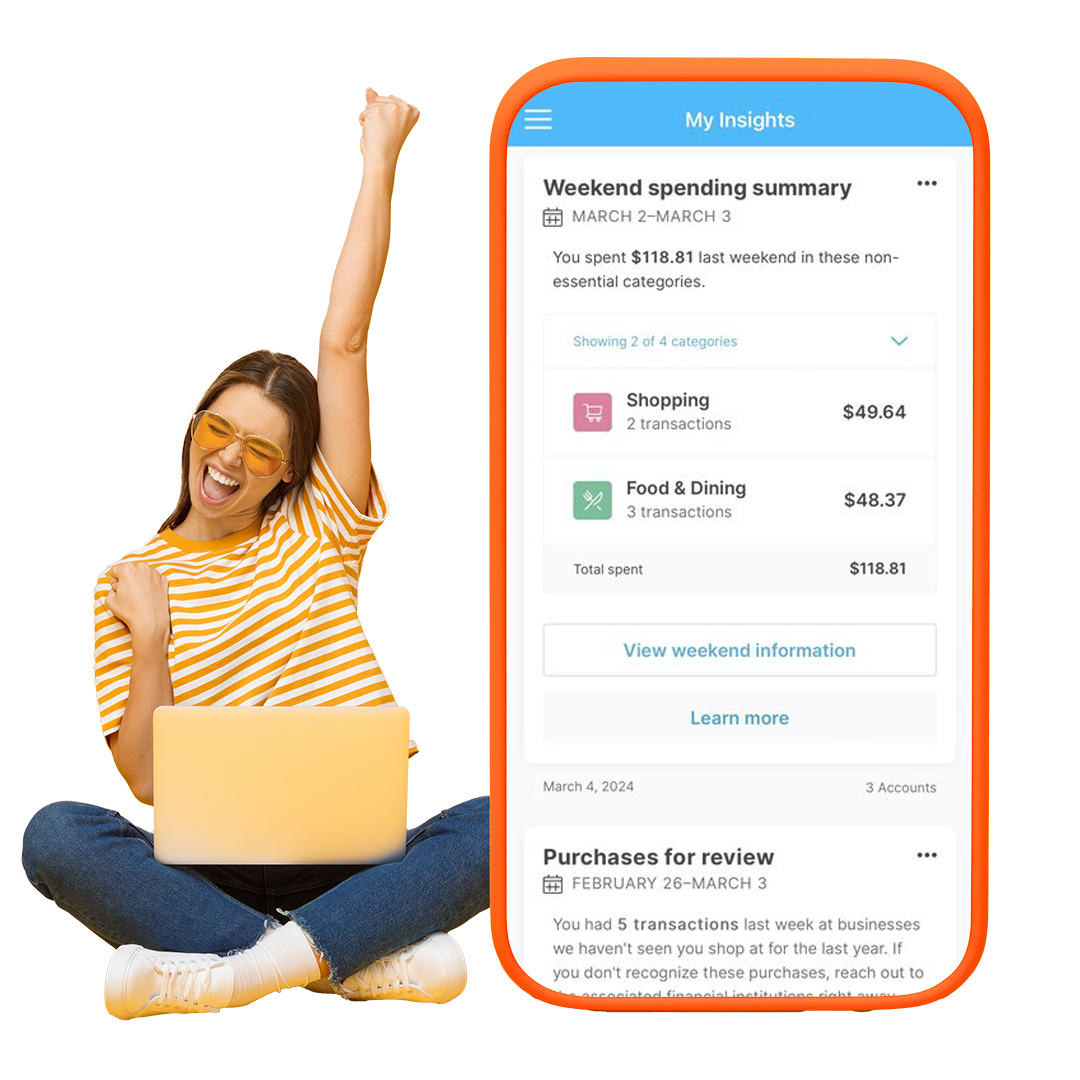

Digital Banking at Suncoast

Digital banking lets you manage your finances quickly and securely using your smartphone or tablet. A Suncoast member can access their credit or debit card statements, grow their savings account, and make instant loan payments with our handy SunMobile app.

Pay Bills and Transfer Funds with Ease

Deposit Checks in an Instant with Your Mobile Device

What is the Daily Deposit Limit?**

We have a daily deposit limit of up to $2,500 for personal accounts. If you have a business account, you will have a daily deposit limit of $25,000. Of course, limits can change and are subject to review. Also, you must meet eligibility requirements to access mobile deposits in SunMobile.

Send Money to Any Bank with Pay a Person

Easily Manage Your Digital Banking Contact Information

See Your Balances with the Click of a Button

Already a Suncoast Credit Union Member? Get Started with Digital Banking

When you’re ready to bank, you can log in any time.

Enjoy the convenience of banking from anywhere, at any time, with our free digital banking options. And getting started is easier than ever. You can enroll online or through our SunMobile app.

Once you’re a Suncoast Credit Union member, all you’ll need to get started is either your member number or social security number. Then follow the prompts to complete your enrollment in digital banking. It’s that simple.