Personal Loans at Suncoast

Personal loans can support debt consolidation, vacations, home improvement projects, car expenses, or anything in between. As a not-for-profit credit union, Suncoast offers low-rate personal loans for whatever you need.

Discover the Right Personal Loan for You

Select an option below to explore personal loans to borrow:

Explore Suncoast Personal Loans Benefits

Calculate Your Loan Payment

Personal Loans Rates

^Maximum term for APR shown displayed in months.

More Than Just a Credit Union

Good For You. Good For The Community.

Whether you’re banking on the go or giving back Suncoast makes it simple for you.

Giving Back is in our DNA!

A swipe, tap or click from your Suncoast debit or credit card supports our local communities through the Suncoast Credit Union Foundation.

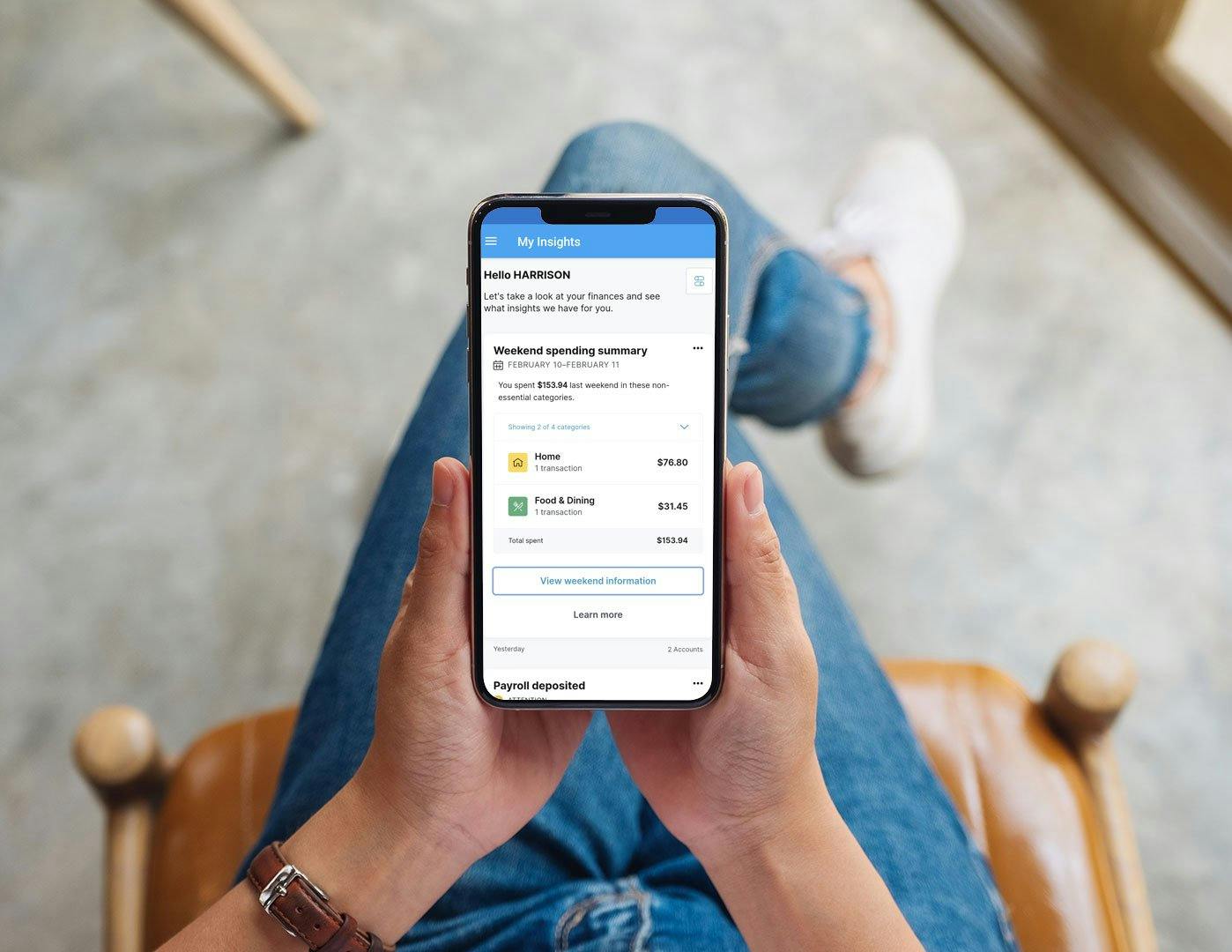

Download the SunMobile App

Our SunMobile app lets you manage your finances quickly, safely and securely from the convenience of your smartphone or tablet.