Specialty Insurance in Florida

If your current insurance plan doesn’t cover something you need, that’s where specialty insurance comes in. Suncoast works with Members Insurance Center, LLC to provide our members with specialty insurance options, ranging from wedding insurance to pet insurance and beyond.

Specialty Insurance Options

More Than Just A Credit Union

Good For You. Good For The Community.

Whether you’re banking on the go or giving back Suncoast makes it simple for you.

Giving Back is in our DNA!

A swipe, tap or click from your Suncoast debit or credit card supports our local communities through the Suncoast Credit Union Foundation.

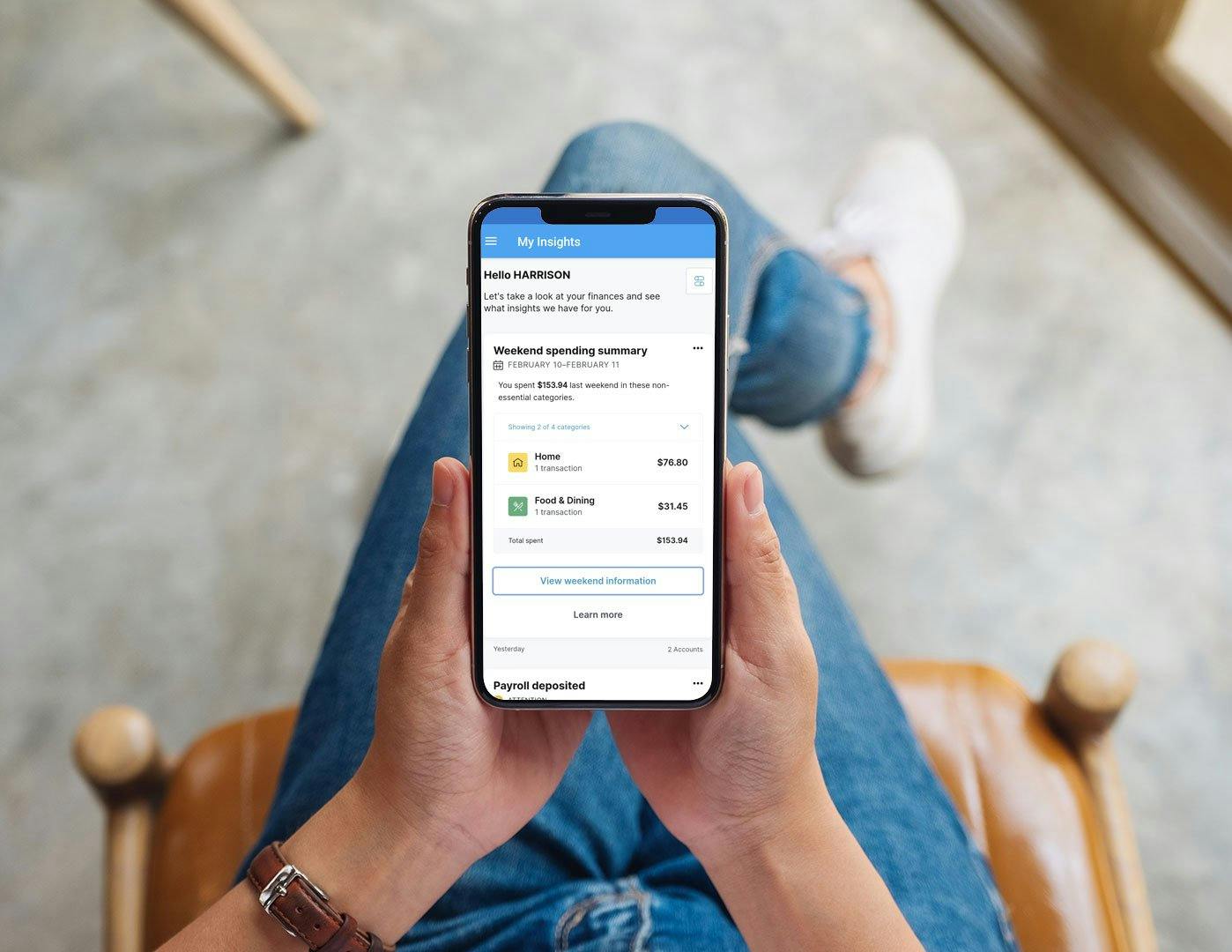

Download the SunMobile App

Our SunMobile app lets you manage your finances quickly, safely and securely from the convenience of your smartphone or tablet.