Business Checking

Suncoast makes business banking simple. Our business checking account has the features you need to help your business thrive.

Discover the Right Checking Account for Your Business

Select an option below to open a checking account with:

Explore Suncoast Business Checking Benefits

Business Checking

More Than Just A Credit Union

Good For You. Good For The Community.

Whether you’re banking on the go or giving back Suncoast makes it simple for you.

Giving Back is in our DNA!

A swipe, tap or click from your Suncoast debit or credit card supports our local communities through the Suncoast Credit Union Foundation.

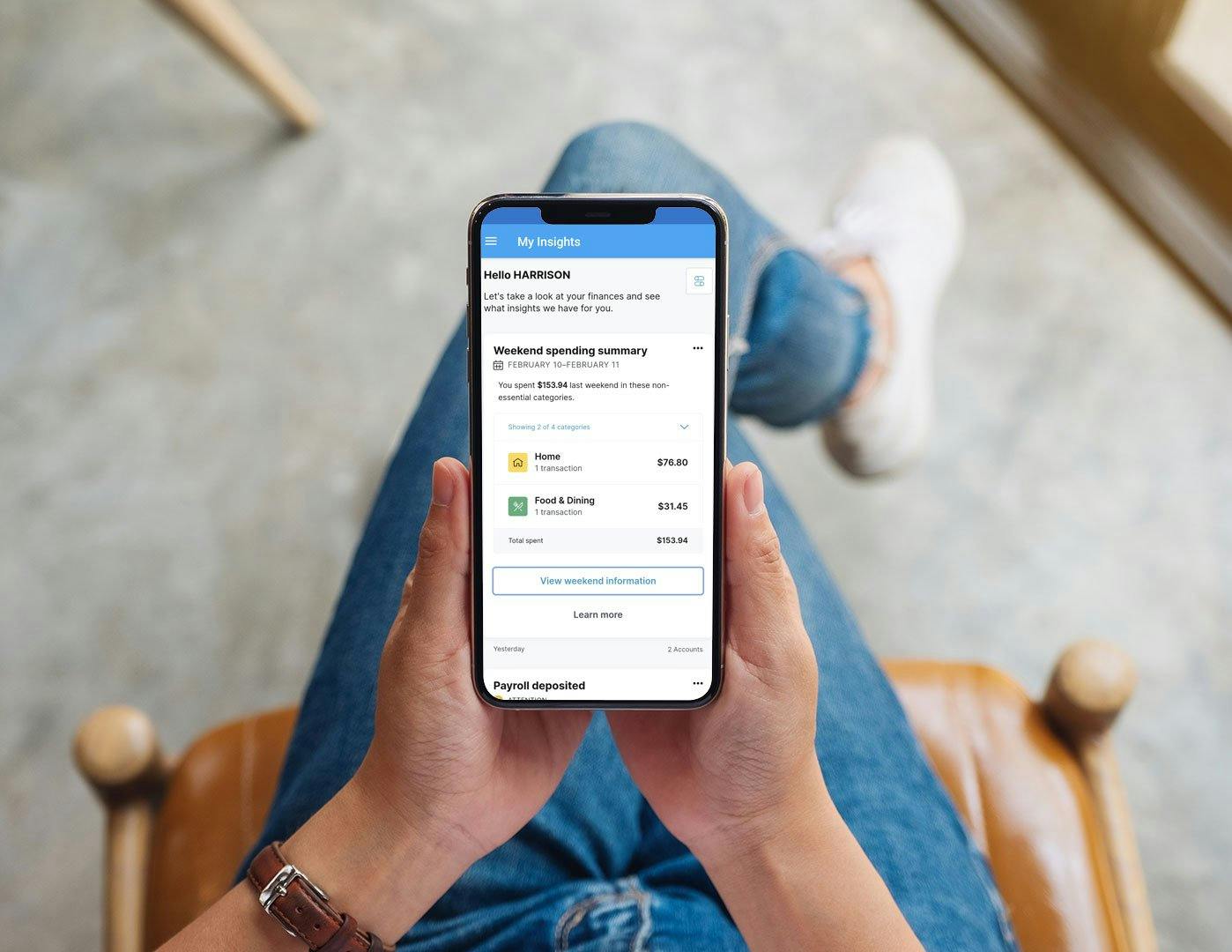

Download the SunMobile App

Our SunMobile app lets you manage your finances quickly, safely and securely from the convenience of your smartphone or tablet.